In these unsettling times, knowledge, patience and endurance are the things that will keep your money safe. Find out, what you; as an investor, needs to know and do when markets are crashing and otherwise, here.

How does one deal with murky market fluctuations?

By the one way the wise have always taught us.

Through acceptance.

Accept the uncertainty of the times. Trying to predict market directions at this time is futile.

How must i deal with my investments ?

Just hang in there !

If you are dealing with SIPs, continue investing. This is when you are buying at a cheaper prices; especially when it comes to Mutual Funds or SIPs.

Can i invest huge funds in the markets when it has crashed ?

This is never advised.

Always invest in parts. Always be certain of your goal. Ask questions like how much fund do you have, how much are you willing to invest now, what is your risk taking ability, how long can you invest, when do you want your money back.

If your time period is limited; say a year or less, then do not contemplate putting your money here.

Only invest if you are looking at things through a long term lens. Wealth creation is for the committed and requires you to take the long haul.

DO NOT rely on the stock market recovery for your short term goals.

What to look for when Investing

Asset Allocation– While investing do not look for higher growth funds. Always find the middle ground for a balanced investment.

Invest a certain portion based on your risk profile and a certain portion in equity.

So allocate funds in asset classes based on your risk appetite.

Goal based investment– Always know your purpose of investing. If you have none, go forth and create one. Take time out to define your goals. Do this and you will be paid back handsomely, eventually.

And based on this clearly envisioned goal, you will know what asset class is right for you.

This is the time to invest based on one’s knowledge. If not, take professional aid. Look for a financial advisor who is qualified; who can probe into your needs, your risk capacity, your investment time frame, the surplus amount you are willing to invest and eventually suggest the area of investment catering your needs.

What to stay away from

With the many advertisements offering unsolicited advice on how to handle money during a market crash, do not fall prey into making investment decisions based on this.

Always study thoroughly or seek help of a qualified financial advisor for the same.

What must your checklist contain?

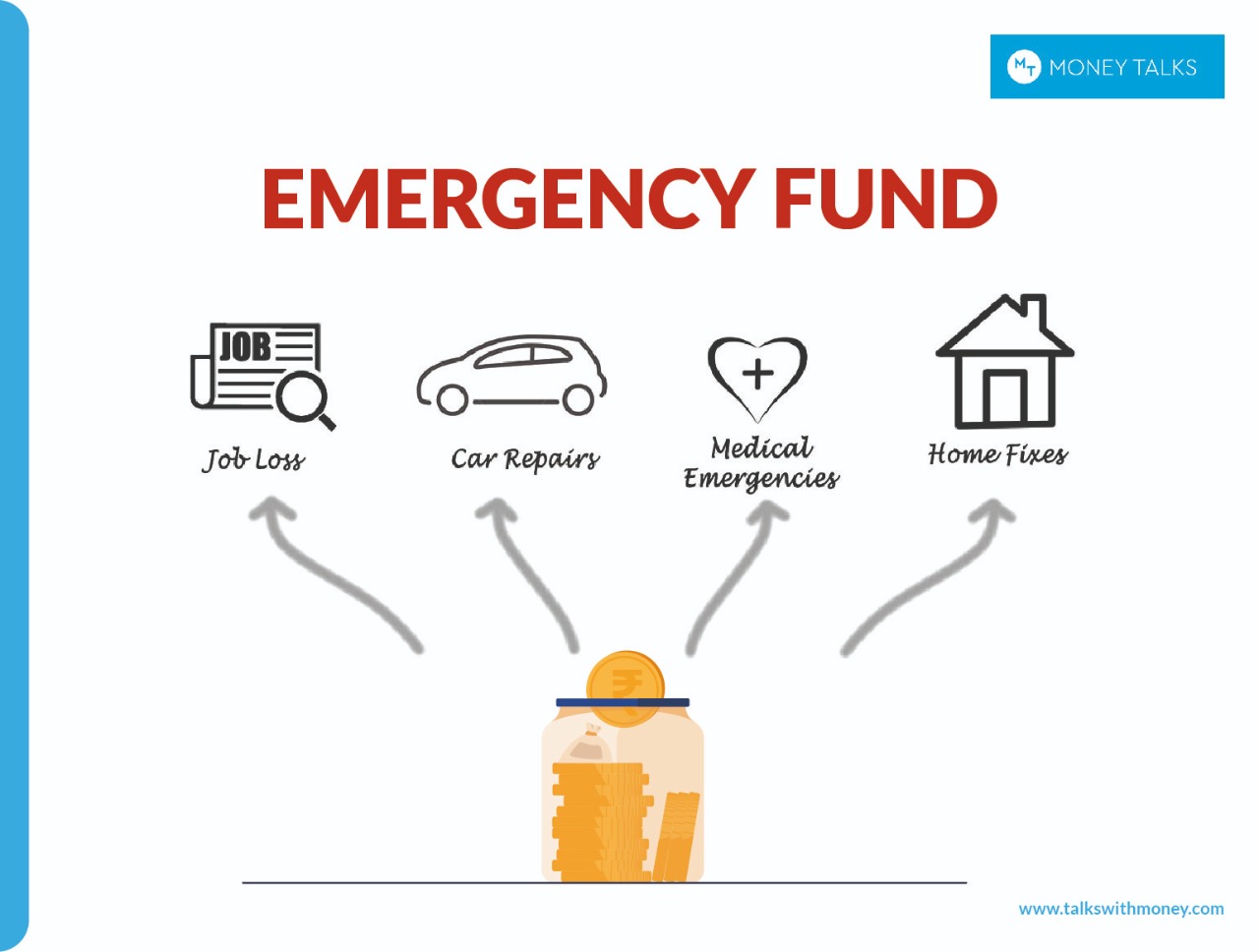

Check if you have an emergency fund, if you have made arrangements for any short term investments. Check and invest safely in options like debt fund, fixed deposits etc. and not in equity in these volatile times; which will require you to take risks.

Also, check if you have insurances– like term insurance, medical insurance etc.

It is also not the right time to buy loans once the market has crashed.

Financial discipline is your responsibility. This is what you owe your money. Always take advice before investing.